The Indian jewelry market: everything you need to know about today's consumer

Indian jewelry - aesthetics, spirituality and financial certainty

In India, jewelry plays important aesthetic and cultural roles, as it is used to enhance the beauty of females, while also being a symbol for wealth, power and status.

For thousands of years, Indian women of all ages have adorned themselves in jewelry, to showcase their femininity and express themselves. Moreover, they often receive precious gem and metal pieces from their spouses and family, to mark important moments.

Still, jewelry isn’t just associated with visuals and spirituality, it also has a very strong financial dimension. In India, heirloom jewelry is considered an excellent investment which makes women feel secure in times of crisis. This is why all women, no matter their status, ensure that they have jewelry put aside.

The Indian jewelry market is expected to reach $100 billion, by 2022

According to figures shared by representatives of the Confederation of Indian Industry, India is responsible for almost 29% of the global jewelry consumption, as its market size is expected to reach the $100 billion threshold, by 2022.

The market is split between products for women, as well as children and men. Particularly the last category is well represented in India, where Mughals and maharajas are known for their beautifully-adorned looks.

Consumers buy jewelry predominantly from domestic brands that they trust, such as Tanishq, Kalyan Jewellers, PC Jeweller or Joyalukkas. Still, in the past decades, they have also discovered and interacted with international brands like Cartier, Tiffany & CO., Pandora or Swarovski.

Image credit : Tanishq

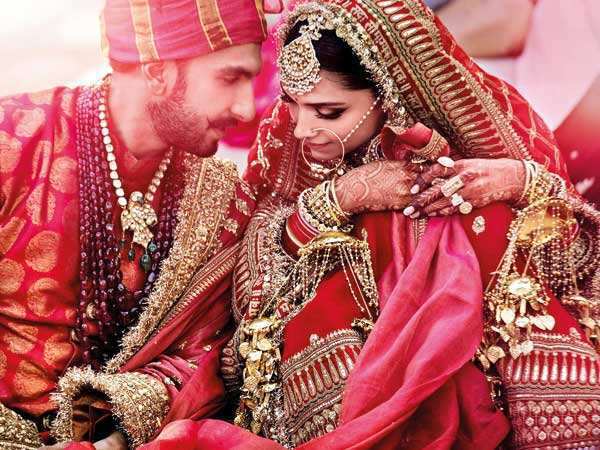

The Indian wedding market accounts for over 50% of jewelry sales

Indian weddings are extremely important events, recognized for their complexity of rituals and traditions. As figures from Business of Fashion, quoted by Jing Daily, show, annually, in the country, an average of 2,000 high-end weddings take place, with a budget of $2 million.

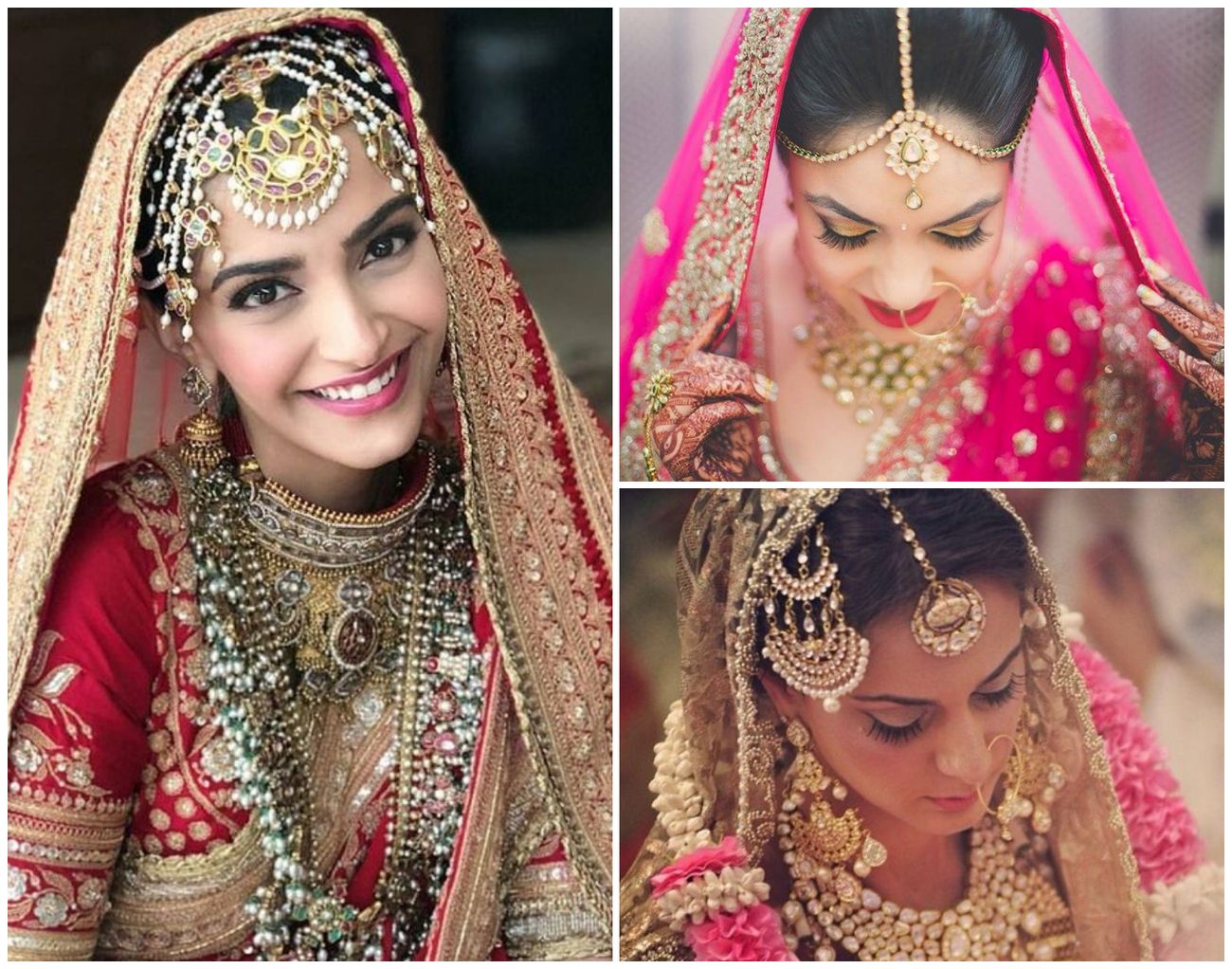

Image credit : Kaylan Jewellers bridal campaign

Moreover, in India, wedding jewelry accounts for over 50% of all jewelry sales, showcasing how important this event is for both consumers and brands.

On her big day, the Indian bride wears jewelry from head to toe, both to complete her colorful look and to showcase her family’s status and wealth. The sets for high-end events may cost between $10,000 - $40,000, while a couture one may reach $100,000.

In order to shine bright, when getting married, Indian brides wear several types of jewelry pieces, such as: anklets, bangles, rings, nose rings, earrings, hair pins, necklaces, waist bands. Of course, the famous maang tikkas cannot miss from the look, as they are chosen to match the necklaces and earrings, as well as compliment the women’s forehead.

Several Mang Tikka exemples. Image credit : You me and trends

Industry voices say that, taking into account that the actual events are getting smaller, due to COVID-19 pandemic restrictions, families will redirect their savings towards jewelry, thus fostering the market.

Indian consumers prefer gold and diamonds

According to Investopedia, India is the top consumer for gold jewelry, with 136.6 tonnes, in Q4 of 2019.

In Indian culture, gold symbolizes prosperity, as well as long term commitment. This is why it is the preferred precious material, especially for wedding traditions, while more modern brides also choose silver and platinum.

Gold is also associated with the Hindu Goddess Lakshmi and with festivals like Dhanteras and Akshaya Tritiya. In these times, people who buy the precious metal are doing it to attract good fortune.

Still, Indian consumers also appreciate diamonds. As figures show, India processes 1 billion pieces of diamonds annually, out of which 25% is for internal consumption, which means that domestic sales of diamonds are somewhere around $5.75 billion.

Manufacturers and designers point out that, since 2013, consumers’ have been more interested in diamonds. In 2018, retail representatives emphasized that the demand, in terms of gold versus diamond studded jewellery, was between 90-95% for gold and 5-10% for diamonds.

Even India’s most wealthy consumers still pay attention to materials, more than branding

By 2025, India’s ultra-high-net-worth individuals (UHNWIs) - people with wealth of over $30 million -, will grow by 63%, reaching 11,198, according to Knight Frank India. The percentge is extremely important, taking into account that it is significantly higher than the global rate of 27%. Moreover, the country’s number of billionaires is now at 113, showcasing that there is much wealth accumulated in the country.

Given India’s rich culture and passion for heirloom jewelry, precious gems and metals are the main preference for consumers. As the De Beer’s report shows, in the 2020 holiday season, over 4 out of 5 men in higher income groups were interested in purchasing diamond jewelry for their significant others.

Heirloom jewellery as wedding gifts. Image credit : Times of India

What is extremely interesting is that even high income jewelry consumers place much importance on the actual materials than on the brands themselves. The reason is that it is in the people’s culture to perceive jewelry as investment and, thus, assess it taking into account the type and weight of gold, as well as the diamonds’ carats.

Still, international companies have managed to penetrate the Indian market. Their objective is to get consumers accustomed to their luxury standards, so that they also consider aspects like heritage, brand, associations etc.

5 trends that are shaping the Indian market

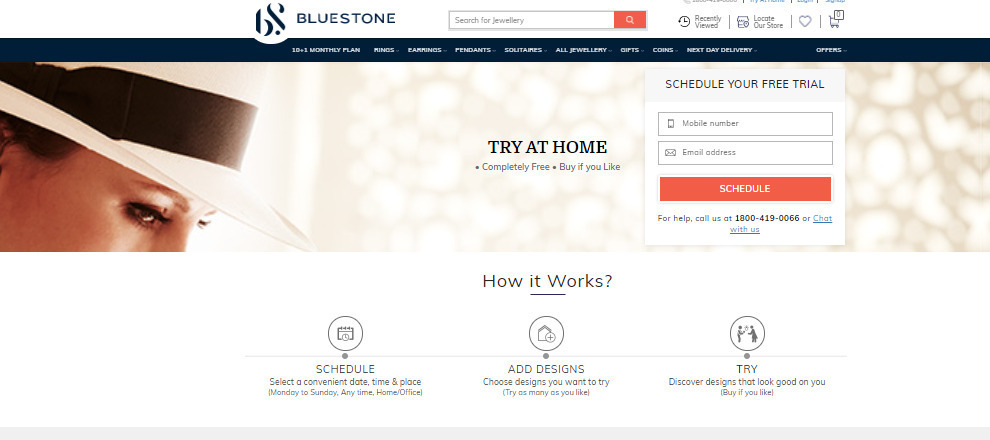

1. Online shopping and product discovery are developing

E-commerce is gaining ground in India, where, according to the 2021 Digital report, 76.7% of Internet users between 16 and 64 years’ old purchased a product online, in the past month. In total, over 548 million consumers purchased 46 billion worth of goods online, in 2020.

According to the Online Gold Market in India report, issued by the World Gold Council, consumers aged 18 to 45 represent about 70-80% of online shoppers. The average bill is somewhere around RS 25,000-30,000.

As the same report shows, a mere 1-2% of gold jewelry purchases are made online, as 17% of urban and 3% of rural gold jewelry purchases are made using an e-channel.

Still, the trend is an ascending one. The Indian market for jewelry was assessed at $850 million, in 2019, and is projected to reach $3.7 billion, by 2025.

Image credit : Bluestone Online jewellery, try at home service.

Indian specialists know that the role of e-commerce doesn’t end here. Digital technologies and channels, such as social media, online blogs, direct-to-consumer websites and apps play an important part in delivering ideas and inspiration to consumers, contributing to the discovery and decision-making stages and, thus, leading towards conversions. This is why it is important for jewelry sellers to have strong digital presences, as well as reach consumers with consistent messages.

2. Millennials want to buy diamonds from ethical brands

According to Morgan Stanley Research, there are 400 million Millennials in India, which means they represent one third of the country’s population and almost half of the workforce. In this context, the age group is a powerful force in any household, as Millennials appear to be the family’s main income earners.

The way they spend their money and the jewelry they buy impacts the Indian market as a whole. This is why many mass market trends are shaped by these Gen Y-ers.

Of course, Indian Millennials are similar to those worldwide, which means that they are significantly better educated and more connected, compared to their parents and grandparents.

They place bigger importance on ethical brands, which have a social impact, respect the environment and their employees. Knowing how a jeweler sources its raw materials, under what conditions it processes them is extremely important, because it helps shoppers have a more holistic perspective on the brand.

Diamonds are in the top preferences of this audience group which is not afraid to play with sizes and styles. Smaller diamonds, sometimes of lower quality, are preferred for daily use and for stackable looks, while more expensive ones, with better clarity are dedicated to special occasions.

Image credit : Forevermark - ring stacking

A popular example is the Forevermark Rac N Stac diamond ring, which Indians very much appreciate. This may be adjusted with different types of enamel bands, to change its color, according to the user’s mood.

Moreover, Millennials’ appreciation for less expensive, ethical diamonds has gone so far that the demographic has created demand for lab-grown diamonds. According to Statista figures, quoted by Forbes India, India is the second market for lab-grown diamonds, totalling 15% of global sales.

3. Niche, minimalist designs for daily wear

Indian jewelry is associated with maximal looks, elaborate, complex and expensive pieces, often created for brides which want to shine. Still, while the wedding Indian market for jewelry is consistently growing, there is another one that is taking shape.

Young, fresh and modern designers are offering a new path for the Indian consumer, creating a minimalist aesthetic that has been well received by shoppers.

More and more women started appreciating jewelry that was suitable for daily use and which could compliment a business outfit or a sari.

Brands like Olio Stories, Kichu, Dhora or The Line create signature, creative pieces that make a statement and enable consumers to express their styles and personalities.

Image credit : Olio stories

Image credit : Dhora

Due to the fact that their price ranges are in the affordable area, these types of pieces may be associated with different outfits, enabling women to be more versatile and play more with their looks.

4. Indian women are buying jewelry for themselves

Until recent years, in the Indian society, men, particularly those in father and husband roles, were the ones to buy jewelry and were the main, paying demographic. Women were less likely to make purchases, especially since their finances were controlled by their mothers-in-law, a practice known as the Saas-Bahu relationship.

Since women started joining the workforce and earning their own money, financial freedom has become more common, impacting the jewelry market.

According to jewelry designer Eina Ahluwalia, quoted by the New York Times, nowadays, the non-gold mass market is dominated by women who are buying jewelry for themselves, as a form of gratification.

Moreover, as the aforementioned De Beer’s report showcases, in the 2020 holiday season, more than four out of five higher income women intended on purchasing diamonds for themselves.

5. Customization is in the Indian consumer’s DNA

India’s legacy in what jewelry is concerned is undeniable. The country’s heritage, appreciation for heirloom jewelry, as well as its many manufacturers are known worldwide. With such a rich history of gold boutiques, rituals and craftsmanship, the Indian consumer is quite habituated with customized pieces, often made-to-order.

This is why, in today’s fast-paced society, many are still looking for jewelry customization. Companies, big or small, are offering this service on their websites and in their stores. Adding 3D visualization and product configuration to a product’s page is a tool that many consumers appreciate, especially tech-savvy Millennials which power the industry.

Conclusions

While the Indian market for jewelry is still dominated by the wedding sector, consumers’ preferences are shifting, as Millennials are opening up the Indian society to more global trends. Interest in minimalism, ethical brands, responsible practices, digital technologies and experiences is increasing and companies need to adapt to the changing landscape.

By Anne-Marie Diom, Ana Doaga - Thu Sep 02 2021